Question: What is the best mobile payment option for processing credit cards on the road using a mobile device? How does Square compare to Sage Mobile Payments? Recently, as the Treasurer for Inland Empire Grant Professionals Association (GPA), I was asked by the Board of Directors to investigate how we were processing Credit Cards while at our local chapter meetings and annual conference.

Answer: As an ERP consultant, I put on my investigative hat with 20 years of experience exploring options for business and technology solutions. I checked out both Square, which is what GPA was using at the time, I also checked out Sage Mobile Payments. Here are my findings on Square vs Sage Mobile Payments:

First, I came across an article about Girl Scouts Implementing Sage Payment Solutions, the article stated: BizReport recently explained that the Girl Scouts of America Cookie Fundraising program had partnered with Sage North America to accept mobile credit card payments. According to the news provider, Girl Scouts chapters in 23 states are now capable of accepting mobile payments through advanced processing technology that can be used on the go.

The source explained that 40,000 Girl Scouts have the tools necessary to accept mobile payments, which one study found to have increased revenues significantly. For example, the Fresno, California chapter experienced massive growth following the mobile payments initiative, with annual transactions increasing from $20 million in 2011 to $80 million in 2012, representing 400 percent year-over-year growth. Wow! Just think of the revenue increase if Girl Scout’s come to your door selling cookies with a Sage Payment Solutions mobile device on their smart phone. Now all you would have to decide is do you want a year’s supply of Thin Mints or Snicker Doodles?

So the thought was if the Girl Scouts could implement this why couldn’t Inland Empire Grant Professional Association?

Second, then we investigated Square that had been used for the last year, we found out:

Square is expensive (if you use it) and is not fully encrypted. Though it is heavily marketed, it is a bad choice for many reasons. Most importantly, it exposes customers to potential credit card fraud. There was a YouTube video that showed how easy it was to steal numbers off of phones that used the Square but it got removed for obvious reasons.

Here are some points we learned in our review about on Square that may encourage you to consider other options like Sage Mobile Payments:

- A merchant that processes more than $1,000 per month has those excess funds held for 30 days.

- Rates are much higher than standard processors and the card reader often doesn’t capture card data leading to a 3.25% rate even though they quote a lower rate.

- Sage offers post back into QuickBooks, Sage 50 and other accounting systems.

The value with Square is that if you don’t ever use it there is no monthly fee. Sage has no monthly account fee, but charges a $10.00 monthly minimum which means that if you actually use it the minimum doesn’t matter and the rates are about 100 basis points less.

Third, based on this information, Inland Empire Grant Professionals Association adopted Sage Mobile Payments.

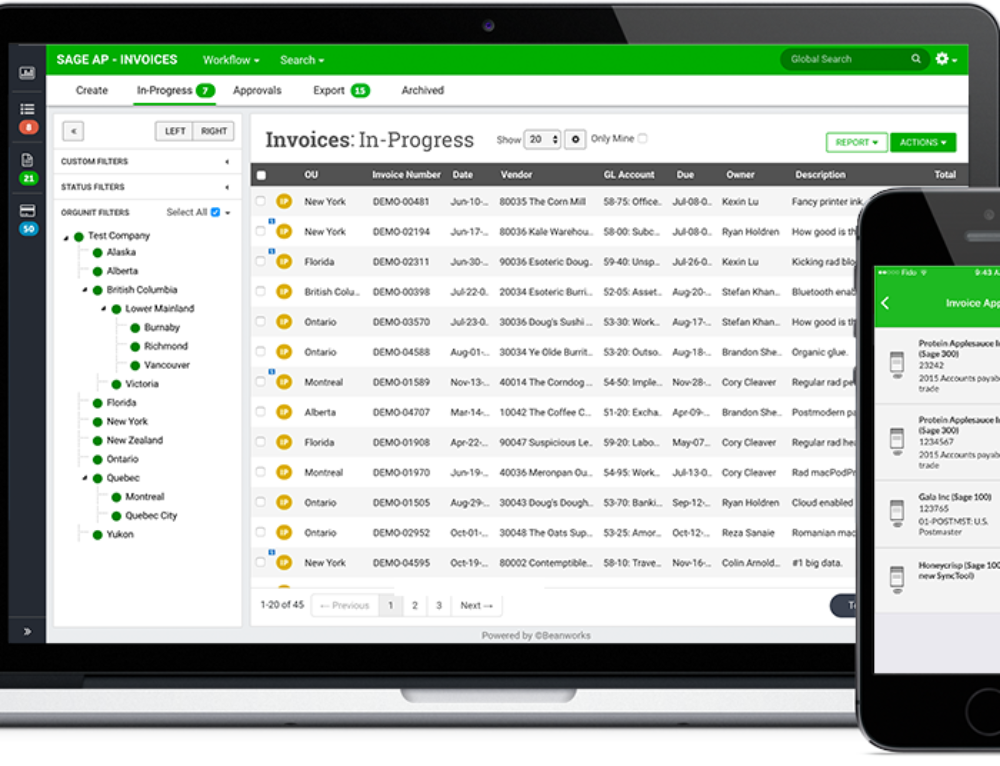

We set ours up on a wireless iPad, so that when we are sitting at our monthly meeting and checking people in we can take care of the processing right at the check-in table. Sage Mobile Payments also works with other smart devices such as iPhones and Android Phones so it is totally mobile. Sage was able to set us up quickly and we are very happy with Sage Customer Support. Sage has a great reputation with over 20 years of excellence for delivering useful solutions with dedicated and timely customer service.

We offer these tips and tricks on a weekly basis. Please stay tuned for more useful Sage 100 ERP information…

As ERP consultants for Sage 100 ERP (formerly MAS 90 and MAS 200) we come across Sage 100 customers who need help with how to fit their business processes into the everyday features and functions of their Sage 100 ERP software. If you are a Sage 100 ERP customer and have questions, please don’t get frustrated. Pick up the phone and call us 760-469-9205!