Question: Mike, we own Sage 100 (formerly MAS90) and we would like to know how to reverse a check and invoice in Accounts Payable.

Answer: Sage 100: How to reverse a check and invoice in Accounts Payable.

NOTE: We advise that you consult with your certified Sage 100 ERP consultant before making any changes to your Sage 100 system. If you don’t currently work with a Sage 100 consultant, contact us, call 760-618-1395 or email us at info@caserv.com and we are available to help.

Steps are show below:

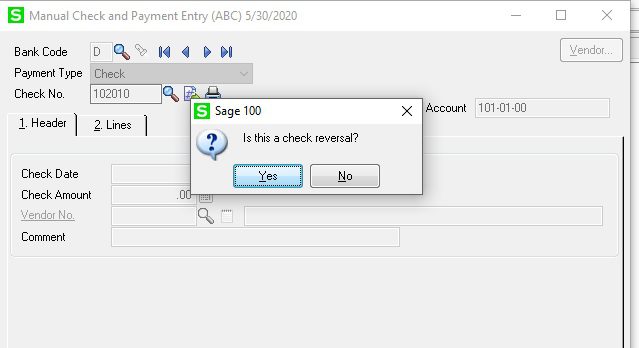

- First Modules>Accounts Payable>Main>Manual Check Entry, and type in the check number you want to reverse. The system will ask you “Is this a Check Reversal”, click Yes.

- The system will them ask “Do you what to recall invoices paid by this check”, click Yes.

- You will then see a negative check on the register, Accept and Post the Manual Check Register.

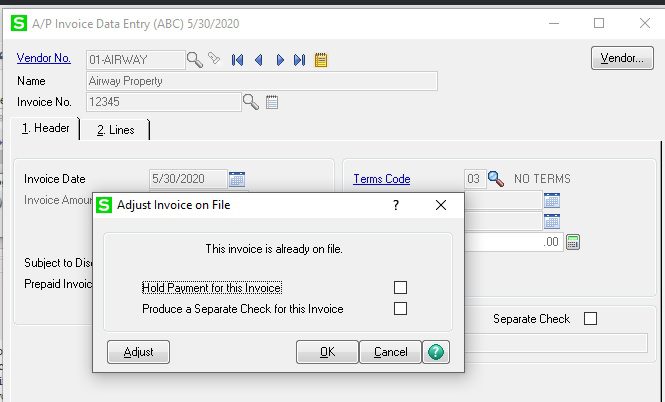

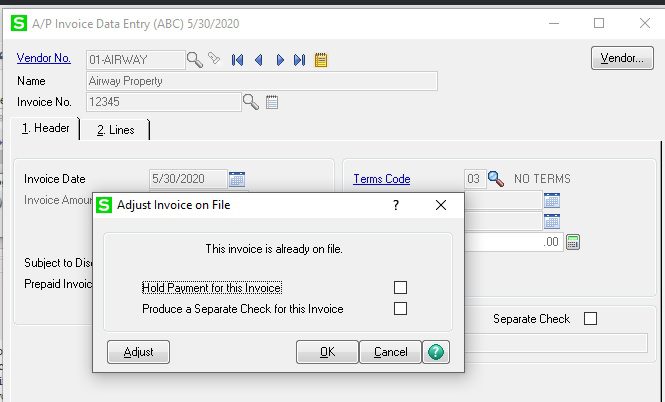

- So now you want to reverse the invoice with an Invoice Reversal, go to Modules>Accounts Payable>Invoice Data Entry.

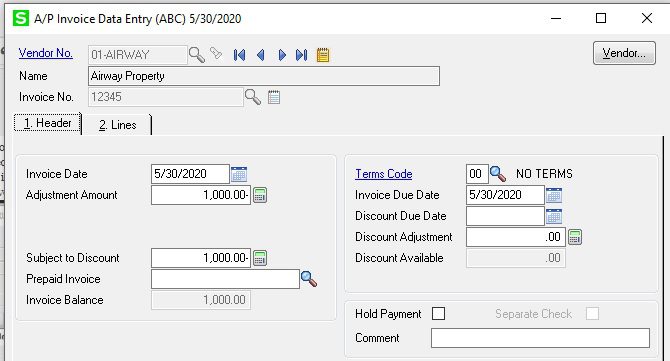

- Put in the Vendor N0. and Invoice No., and you will see the Invoice Adjustment popup, click Adjust.

- Next put in a negative amount in the Adjustment Amount and Post the Invoice Register, this will reverse the Invoice.

How do I find out more information? You can contact us via our Contact Form, call us at 760-618-1395 or email at info@caserv.com.

Written by Mike Renner: WAC Solution Partners are dedicated to offering business solutions like Sage 100 (formally MAS 90) with over 25 years in the accounting software industry.

Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage. Specialties: Sage 100 (formerly MAS90), Acumatica, QuickBooks Pro Advisor.