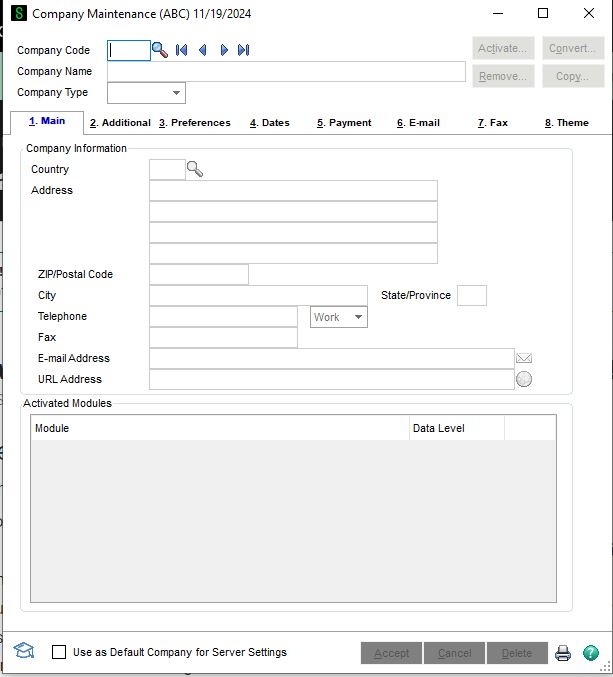

Sage 100 – Review of Making a Backup Company.

Making a Sage 100 backup company comes up often, so thought it was worth publishing this again. At year end, doing training or updating the databases it is always good to have a backup company. [...]

Sage 100 – What’s new in Version 2025.

Last week we attended an update by the Sage 100 Presales team on version 2025 of Sage 100. It was released in April 2025, it introduces several enhancements aimed at improving efficiency, security, and user [...]

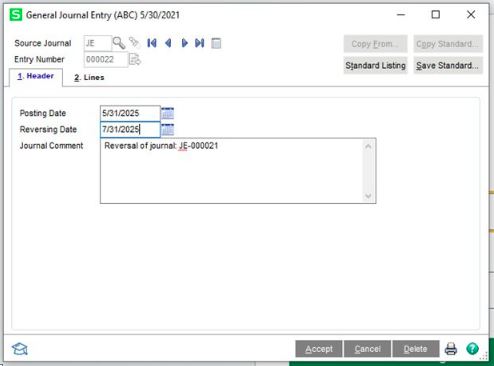

Sage 100 – How to change the date of a Journal Entry.

We thought this was worth reviewing again: Question: Mike: We posted a Journal Entry to the wrong date and would like to reverse it out and post to a new date, how is this done? [...]

Sage 100 – Upcoming Payroll and Version Updates.

We recently attended a Sage 100 Update session for Sage Business Partners. There are updates coming and thought we should make our customers and partners aware. In December 2024 Payroll Version 2.25.00 and IRD/1099 for [...]

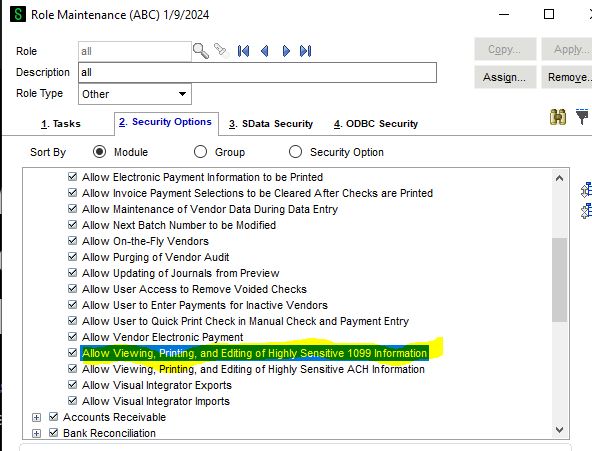

Sage 100 – Our 1099 Taxpayer Id. No is truncated after upgrade.

We recently upgraded one of our customers from Sage 100 version 2020 to Sage 100 version 2023. The customer was trying to access the 1099 data on the additional tab of Vendor Maintenance and noticed [...]

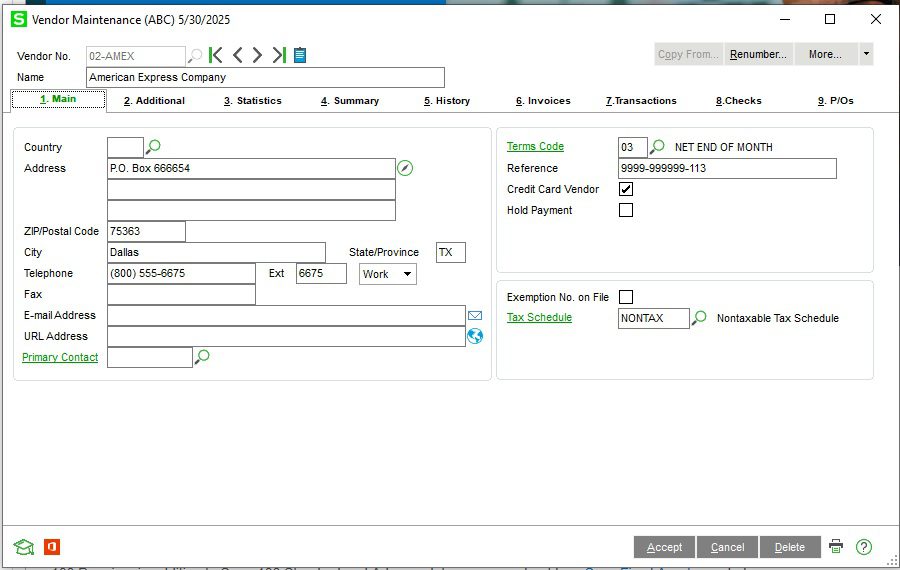

Sage 100 – Review of how to process Credit Card Payments.

We have had some questions recently about processing vendor Credit Cards, thought it would be worth republishing this blog. Question: How do with process Credit Cards in Accounts Payable and Transfer Invoices to the Credit [...]