Question: Recently we got this question from one of our customers and thought it was worth addressing.

Hi Mike, Do, you have a blog on how to issue a check refund to an Accounts Receivable customer for overpayment?

Answer: In our discussion with our client about their customer, they had been overpaid for a long time and did not want to wait for next sale to them to occur and just wanted a check for the amount overpaid.

No utility or magic wand on this one, just basic steps.

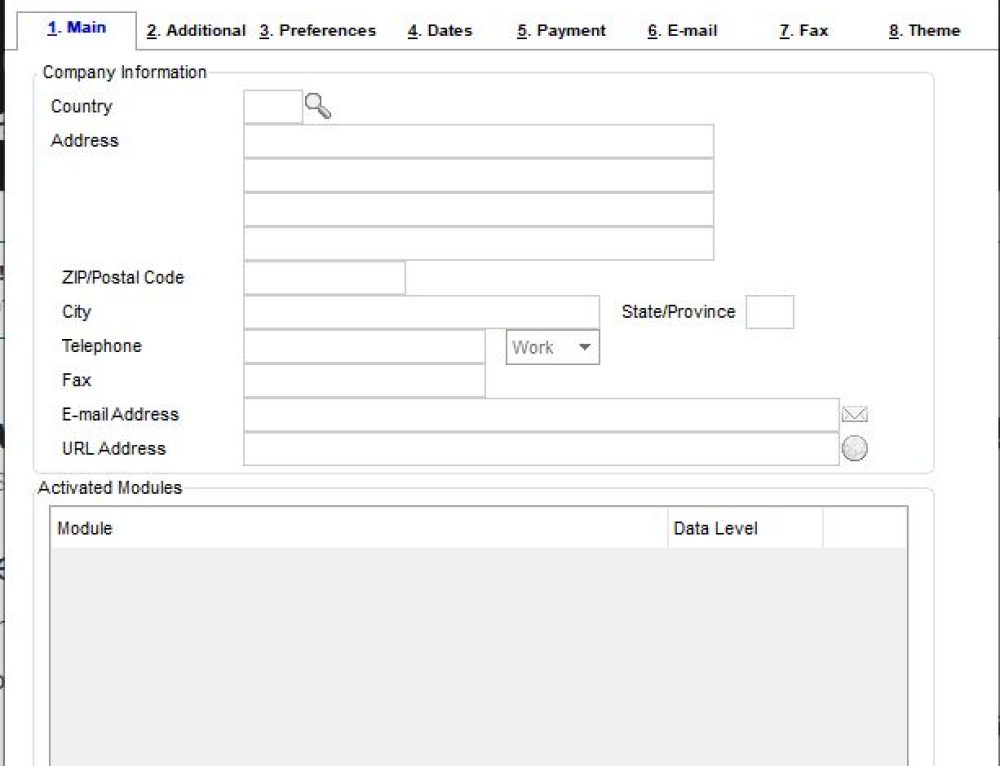

- You set up a new vendor in Accounts Payables, same name, and address as the customer, create an invoice to the vendor and use the same General Ledger number that is in Accounts Receivable for the Customer.

- You can create a new check for the vendor of the amount overpaid, using either Manual Check Entry or use Check Payment on your weekly check runs.

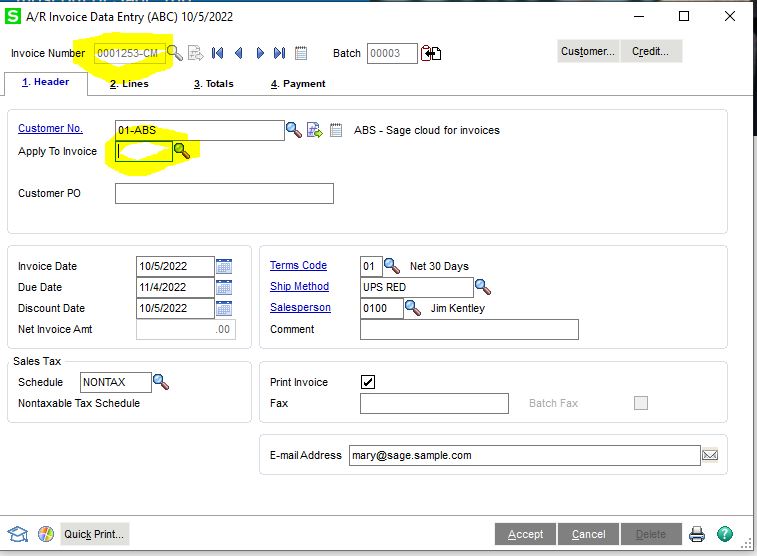

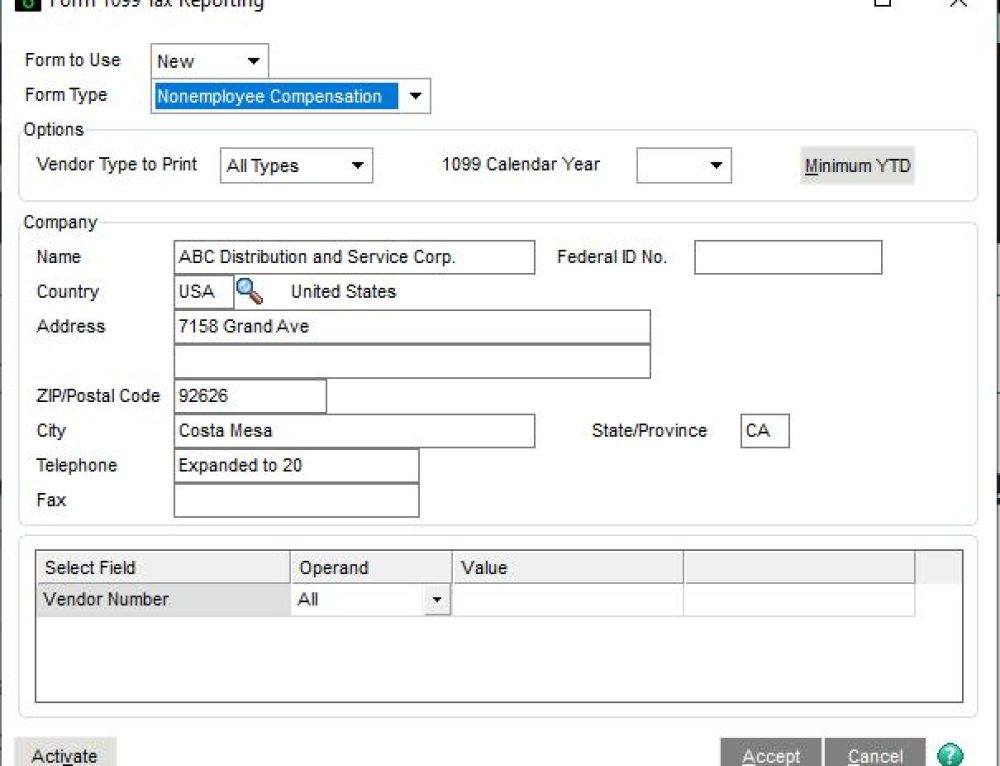

- So then after that the customer will still have a credit balance on their account, you will want either do an invoice adjustment in Accounts Receivable Invoice Data Entry and reduce the invoice by the amount overpaid, or you can do a Credit Memo in Accounts Receivable. We have shown a screenshot below for a Credit Memo example. Just remember to use CM in the entry to account for a negative entry. You can also apply the Credit Memo to the Invoice that was overpaid. You can see the yellow marks below that highlight the CM and Applying the Credit Memo.

Stay tuned for more Sage 100 Tips and Tricks.

Mike Renner – Partner

WAC Solution Partners

local: 760.618.1395 | toll free: 866.400.0WAC (0922) | mobile: 253.861.3120

Single Source Provider of Turnkey Business Accounting & Management Software